Mobile Payment Trends Shaping The Future Of Transactions

Online payment apps and mobile payment solutions have made money management in today’s hectic environment easier than ever. These solutions, which guarantee ease, rapidity, and security at every stage, have completely changed the way we conduct everything from sending money to paying rent.

The days of carrying large amounts of cash and making cheques are long gone. These days, you may easily handle regular payments, transfer money, and pay debts using just a smartphone. Let’s examine the ways in which these developments are altering our financial practice.

Flexibility at your fingertips with mobile payment:

Modern financial transactions rely heavily on mobile payments. A simple touch on your phone or a short scan of a QR code finishes the payment in a matter of seconds, whether you’ve been dining out or buying groceries.

Among the primary features that distinguish mobile payment systems are:

- Speed: No messing with cash or waiting in line.

- Security: Your personal data is kept safe because of advanced encryption.

- Accessibility: You can pay from anyplace at any time.

Mobile payments have grown in popularity and are now the go-to solution for shoppers of all ages. Those who are unfamiliar with digital transactions are most likely to benefit from its ease of use.

Online payment apps as your personal finance helper:

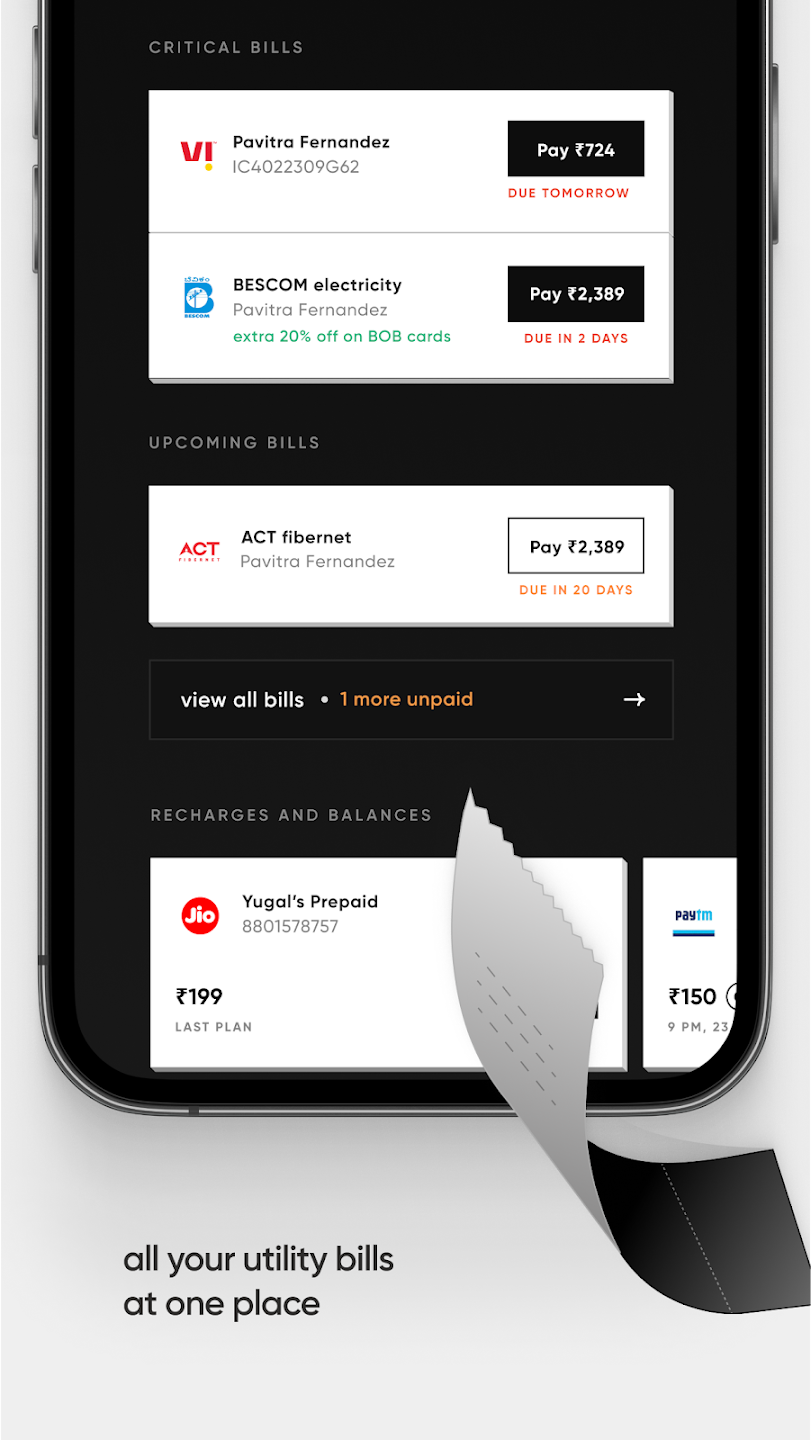

For all of your financial requirements, an online payment app serves as a one-stop shop. These apps are essential in the current digital era because they make everything possible, including online shopping and bill payment.

- Simplified rent payment: Do away with the need to go to your bank or landlord each month. You can make sure your rent is paid on time by automating the process using an online payment app. Additionally, a lot of apps maintain records of payments, which makes money management simpler.

- Easy money transfers: Do you need to give a friend or relative money? These apps’ money transfer functions are made to be quick and easy to use. To ensure flexibility and ease, transfers can be carried out with phone numbers, data from accounts, or even UPI IDs.

- Numerous payment options: These apps include a variety of payment options, ranging from online wallets to credit cards, allowing users to select the one that best suits their needs.

Future of digital payment:

With online and mobile payment apps setting the standard, what is happening with digital payments is developing quickly. These money transfer apps are evolving into more intelligent and adaptable solutions because of features like automated budgeting tools, personalized expenditure data, and fast international transactions.

Convenience and increased security have been the main drivers of contactless payment acceptance. These developments are enabling people worldwide by speeding up, enhancing the reliability, and expanding the reach of digital transactions. The upcoming generation of online payments guarantees even more financial control and ease for every individual as technology develops further.

Conclusion:

The goal of using online and mobile payment apps is to make life easier, not only to stay current with trends. These technologies guarantee that handling your fiscal affairs is not anymore a chore but rather a breeze, handling everything from rent payment to smooth money transfers.

Why wait, then? Adopt a digital lifestyle and discover how simple it is to manage your finances with a few touches. You hold the power to achieve financial independence in the future!