Budgeting: The Key To Business Growth And Stability

Budget Planning is crucial for a business to survive. It helps you understand how much funds you have available, what you can spend, and what you will require in the future. Once you better understand the funds you have available, you can cut down on unwanted expenses and allot the money to necessary expenses, like hiring new employees or purchasing new equipment. Your budget will be your guiding light in altering your business plans and priorities and staying out of debt. This will, in turn, help you grow your business and easily get a business loan approved when you need one.

What is a budget?

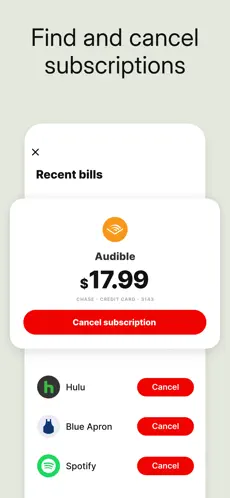

A budget is a document that estimates expenses and income over some time. A basic budget consists of the projected expenses and income for a given period. When you subtract the expenses from the income, the money you have left can be used for other projects and initiatives. A budget also helps tackle short-term obstacles and prepare for the long term. There are multiple tools available to plan your budget. Businesses use spreadsheets or monthly budget tracker to keep track of their income and expenses.

Types of budgeting:

Businesses can use various types of budgets for financial planning. Let’s take a look at some of these:

Increment-based budgeting: In this type of budgeting, you look at previous budgets and add or subtract a percentage from the previous budget period to create the upcoming period’s budget. You can view the budget of the previous period on your business account’s digital banking app.

Zero-based budgeting: Here, each item is set at zero dollars at the beginning of the period before the funds are reallocated.

Value proposition budgeting: Items aren’t added to the budget unless they add value to the company

Activity-based budgeting: First, the company goals are defined, and then from there, you work backward to determine the cost of attaining the goals

Performance-based budgeting: This emphasis is on the cash flow per unit of product and services.

Why is budgeting important?

Ensures availabilities of funds:

The primary function of a budget is to ensure that the company has sufficient money to allocate to resources to meet its financial goals. By planning, you get a clear idea of where you can cut back and which area requires more funding. Utilizing an online banking app helps with planning your financial goals, allocating money to different projects, and committing to your financial goals.

Prioritize Projects:

A budget gives you a clearer picture of your finances, making you more aware of the business’s finances and aiding with prioritizing projects and initiatives. While prioritizing projects, consider the return on investment you get from each project and how they align with your company’s financial goals.

Report on internal goals:

Budgeting is more than allocating funds; it’s about setting revenue targets to achieve company goals. This aids the company in establishing financial goals, which guide the budget and vice versa. The budget helps track progress toward the financial goal and adjust future goals.

It provides a plan:

A budget serves as a financial plan outlining expected earnings and expenditures, but unpredictable events, like the COVID-19 pandemic, can disrupt these plans. Businesses were forced to revise their budgets quickly in response to significant economic impacts. Now, companies are adopting more flexible budgeting approaches, such as zero-based budgeting, to navigate future uncertainties better. A budget provides a plan, but agility is key to adapting that plan during challenging times.

Investment opportunities:

If you’re at a startup or are looking for investors, it’s vital to have documented budget information. Investors prioritize a company’s financial performance when they decide to fund a company. Providing past budget documents and actual spending data demonstrates your financial management skills and ability to adapt. Investors may also request your current budget to assess predicted performance and priorities.

To summarize, a budget is essential for a business to achieve its financial goals, manage its finances, and adapt to changing market conditions. It ensures that funds are available, aids with decision-making, and supports long-term goals. A well-planned budget ensures financial stability and attracts investors, which in turn grows the business. Consider using apps like Chime and Albert to create a good budgeting plan.